The Hongkong and Shanghai Banking Group

Later → HSBC

Registered

3 May 1865Jurisdiction

Hong Kong

Business

Banking ServicesAssets

£2.7 trillionFeatured In

- Bahamas Leaks

- Luxembourg Leaks

- Panama Papers

- Offshore Leaks

In the mid 19th century, Britain had a growing trade deficit with China. The demand for Chinese goods in Europe - in particular the British appetite for tea, silk and porcelain - created an imbalance in the trading relationship between the regions and the silver stocks of the British East India Company were running low. The EIC and the British government needed to create demand for goods in China to claw some back. It begun to export opium from India for resale in China, despite Chinese law prohibiting the consumption of the drug.

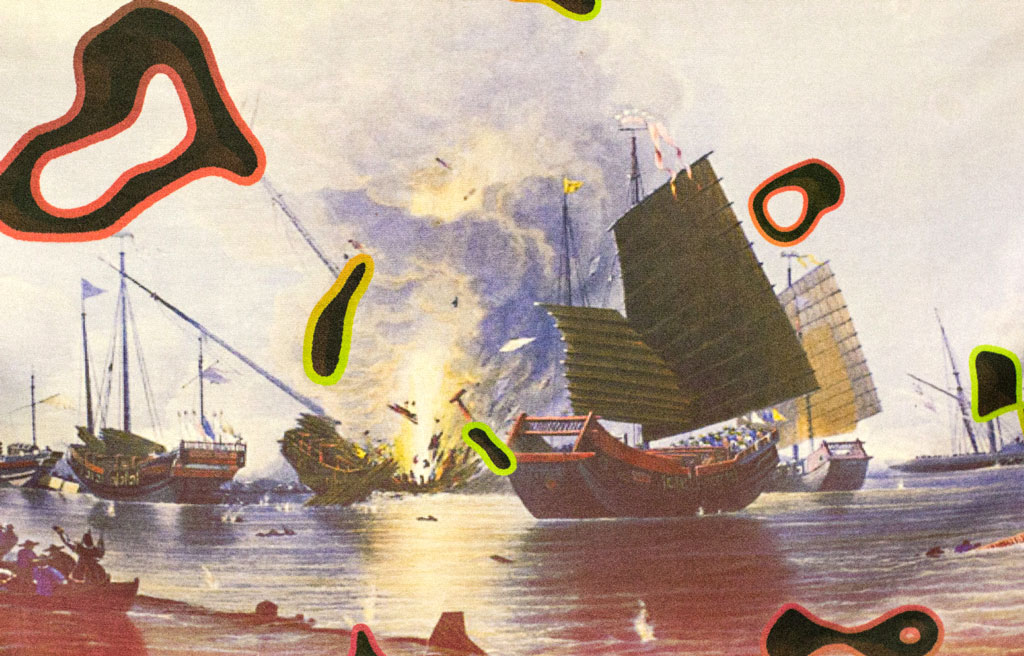

The Chinese emperor attempted to shutter the trade in opium, confiscating 20,000 chests (around 1210 tons) without compensation. In response, the East India Company, with the cooperation of the British Government, undertook to force the trade upon the country through use of its superior naval technology - a tactic known as Gunboat Diplomacy.

On the front of the Towel, we see an aquatint of the British ship Nemesis attacking Chinese war junks. Nemesis was the first British iron warship, and was commissioned by the East India Company, although officially kept off of its list of ships. The ship, it was reported in The Times, was "admirably adapted” for the purpose of smuggling opium and was able to make use of its flat bottom to travel up river and attack Chinese ships and other land-based targets. The Chinese referred to Nemesis as the “devil ship”.

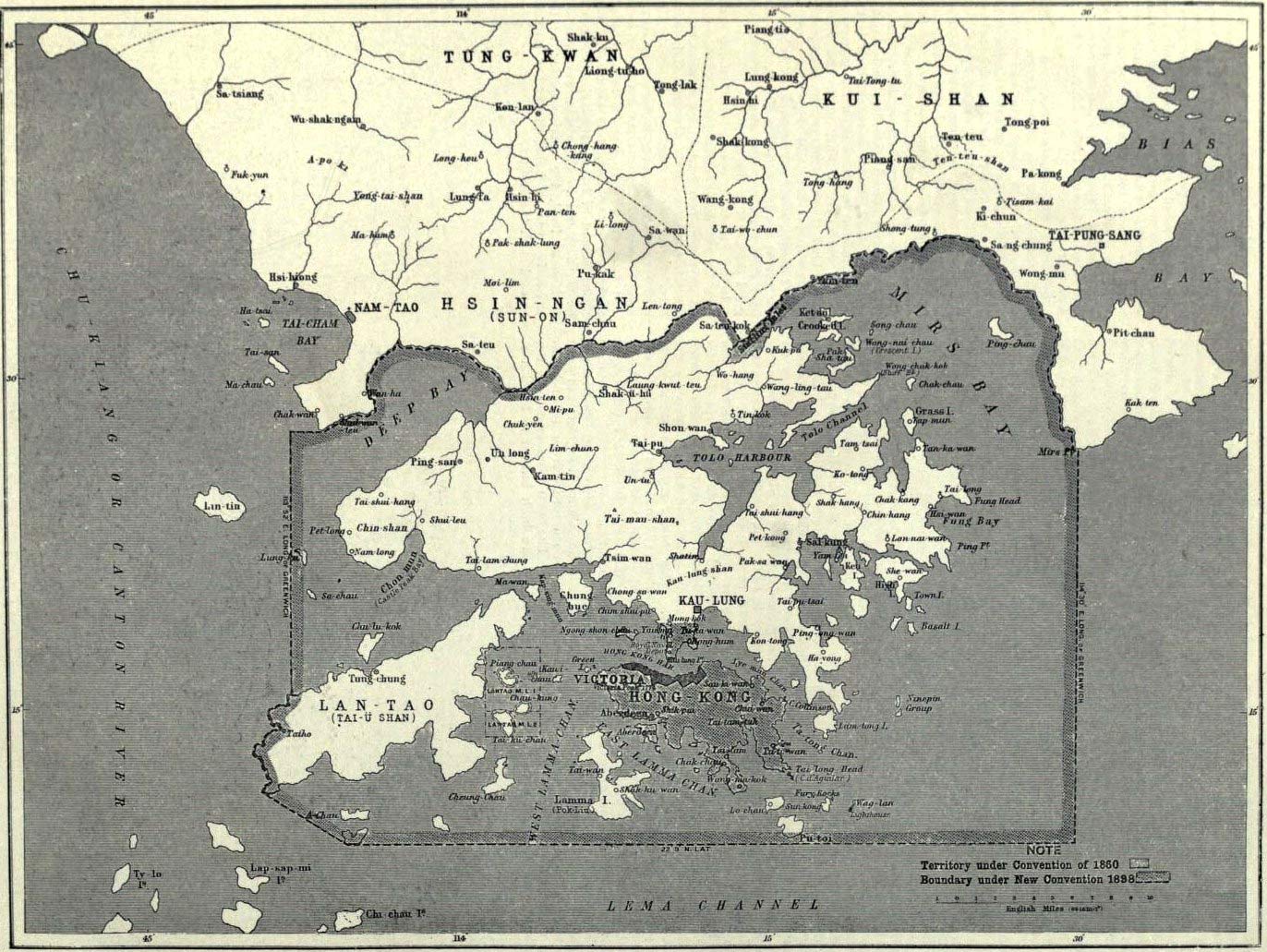

The result of this conflict, which became known as the First Opium War, was a treaty forcing free trade upon China to the benefit of the British, exempting westerners from Chinese law, and ceding Hong Kong island to British control. Although there was no initial, official, change to the status of opium, this paved the way for greater British involvement in Chinese government affairs and opium addiction increased.

The treaty failed to increase trade as much as the British had hoped - they demanded that the Chinese authorities renegotiate the Treaty of Nanking to allow for, among other demands, the widening of trade access for British merchant companies, the legalisation of the opium trade and permission for a British ambassador to reside in Beijing. This demand for renegotiation, alongside a series of smaller diplomatic incidents and acts of aggression lead to the Second Opium war.

The second conflict lead to another unequal treaty (as they were known in China) which further opened trade, ceded Kowloon to the British, and legalised the opium trade. This was signed in October 1860.

The Hongkong and Shanghai Bank was formed in Hong Kong in March 1865 and in Shanghai one month later, allowing it to benefit from the beginning of increased trade into China, and the legalisation of the trade in opium. The bank’s founder, Sir Thomas Sutherland had been director of the Peninsular and Oriental Steam Navigation Company which, in the decade between 1847 and 1857, had transported more than 600,000 chests of opium from india. HSBC’s initial wealth came from the trade in China of opium produced in India.

Throughout the remainder of the 19th and beginning of the 20th centuries the bank operated as banker for the Hong Kong government and participated in the management of British colonial accounts across Asia. Throughout the 20th century the bank remained headquartered in Hong Kong, with a brief period during the Second World War spent in the UK, and expanded its operations around the globe. It permanently moved its headquarters to the UK in 1993, in anticipation of the transfer of Hong Kong sovereignty back to China. The bank gained significant market share in the UK through the takeover of Midland Bank and now came under the umbrella of a parent company, HSBC Holdings Plc. Formerly known as Vernat Eastern Agencies Limited the company was incorporated in 1959 before being kept on the shelf, this would have greatly sped up the creation of HSBC Holdings, as well as providing the company more of a UK history.

In 2012 HSBC found to be in breach of money laundering rules in relation to drug money in Mexico, being referred to as the place to launder money by a drug lord in a recording by Mexican law enforcement. It was also found to have stripped identifying information from transactions made in the USA by countries under international nuclear weapons sanctions such as Iran and North Korea. The bank was fined $1.9 billion by US authorities.