Barclays Bank PLC

Address

P.O. Box 68,Barclays House

Business

Banking ServicesFeatured In

- Luxembourg Leaks

- Panama Papers

- Offshore Leaks

Jurisdiction

Cayman Islands

Assets

£1.3 trillionInvestigated By

- HMRC

- Financial Services Authority

- Serious Fraud Office

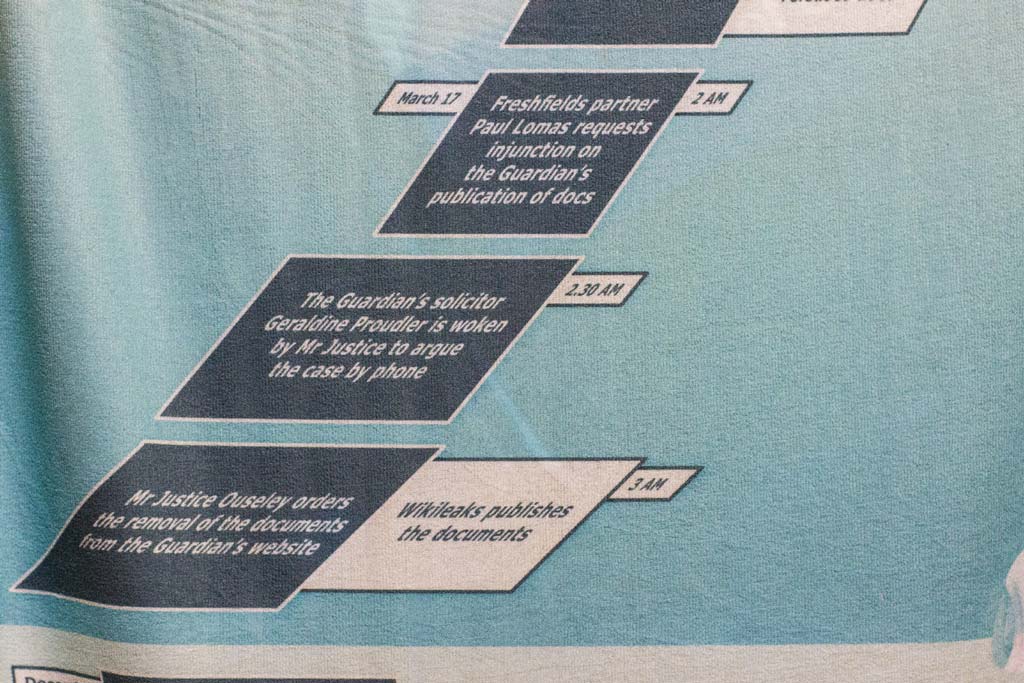

At 2:31am on the 17th of March 2009, Geraldine Proudler, the solicitor for the UK newspaper The Guardian was woken by Mr Justice Ouseley, a British High Court Judge, to defend the paper from an injunction being brought against it by Barclays Bank Plc.

In the days leading up to the phone call, a whistleblower from within Barclays had leaked a selection of documents to Vince Cable, a prominent Liberal Democrat MP, showing questionable financial activity. Between 2005 and 2007 Barclays Structured Capital Markets (SCM) division had put in place multiple operations making use of arcane financial structures and oblique manoeuvres to nullify significant amounts of tax by moving even more significant amounts of capital through multiple shell companies and secrecy jurisdictions. The documents, with codenames such as ‘Knight’, ‘Faber’ and ‘Valiha’, are internal memos relating to the implementation details of these projects. They contain diagrams of proposed capital flows, references to legal advice and, in some cases, the tracked changes of the contributors as they edit precise transaction values and clarify projected tax breaks.

It is a commonly held view that no agency in the US or the UK has the resources or the commitment to challenge SCM

Whistleblower, in covering letter

The documents make reference to other international banks, often particular branches well placed in low tax jurisdictions, as well as to accounts such as PricewaterhouseCoopers, one of the big four accounting firms and law firms such as Freshfields Bruckhaus Deringer, who advised on these structures. Paul Lomas, a partner at Freshfields, was on the other end of the phone at 2:31am, arguing for the injunction to be brought against the Guardian.

As well as providing the documents to HMRC and the Financial Services Authority, Cable gave them to the Sunday Times, which published a story referring to their contents. They were then obtained by the Guardian which, as well as publishing a number of articles referring to their contents, and the letter from the whistleblower, published the leaked files in full. It was on this basis that Lomas was able to argue for an injunction, stating that the files were property of Barclays unlawfully leaked in a way that infringed their copyright and was in breach of confidentiality agreements. Shortly after 2:30 the Guardian was ordered to remove the documents from its website. During this time, these documents made their way to and were published by Wikileaks although, as part of the injunction, the Guardian is forbidden from making known any alternative locations of the documents. Due to the time of day, and distributed nature of the hearing, no detailed records of the arguments exist.

Two days later, the Guardian and Barclays were back in court, with Mr Justice Blake presiding, for formal proceedings to decide whether the injunction should be continued. In referring to the previous case Mr Justice Blake states that the “out of hours” occurrence of the previous injunction "perhaps admirably demonstrates that justice in this country never sleeps”. The Guardian’s lawyers argue that the documents are now widely available and, therefore, the injunction is doing nothing to prevent access to them by the public. The injunction is upheld, and the Guardian remains unable to publish the documents, or to point to their whereabouts.

During the hearing a witness statement by the Guardian’s editor, Alan Rusbridger, is read out, however, and in this he details some aspects of the leaks meaning that they become part of the permanent public record of the court, and the Guardian is able to refer to the remarks in future articles. Following the injunction, further insiders from Barclays and SCM reveal information about its inner workings in relation to these documents.

Every single thing SCM does is a tax trade, the deals start with tax and then commercial purpose is added to them. We were told that in one year SCM made between £900m and £1bn profit from tax avoidance.

Second whistleblower, 19th March

In 2009, Barclays pays £113million in corporation tax. This is 2.4% of its global profit and only an estimated 6.1% of its UK profit. At the same time, Barclays distributes £3.4bn in bonuses. This is 75% of its UK profit.

In 2012, HMRC forced Barclays to repay £500million in tax that it had attempted to avoid through two schemes. In February 2013, as part of an attempt by new chief executive Antony Jenkins to clean up Barclay’s image, Barclays shut down its Structured Capital Management division.